335 Butler Street

P.O. Box 95176

Pittsburgh, PA 15223

Copyright 2011 stichlerlaw.com | All Rights Reserved.

Whether you need legal

representation for a Small Business,

Workers' Compensation, Social

Security Disability, Personal Injury,

Medical Malpractice, Will

preparation, DUI charges, or other

criminal or civil matters, you can rely

on The Stichler Law Office for

effective legal counsel and personal

client service.

To learn if we can be of assistance to

you, please contact us today by phone,

e-mail, or fill out our online contact

form to schedule a free and

confidential consultation and case

evaluation. The Stichler Law Office

represents clients throughout Western

Pennsylvania from its office in

Pittsburgh.

BANKRUPTCY

Have you considered filing for bankruptcy due to overwhelming credit card debt, mortgage

payments, taxes, or other debt? Are you struggling in your current financial situation? The Stichler

Law Office is dedicated to assisting consumers with eliminating or restructuring their finances to

alleviate such hardship.

Tough economic times and a worsening economic climate have made things difficult for everyone.

Many people are receiving harassing letters and phone calls from creditors to pay bills they cannot

afford. Some consumers have concerns of how a bankruptcy filing might impact their credit rating or

financial stability in the future.

Filing for bankruptcy can eliminate many types of debt and halt collection efforts by creditors, while

at the same time allowing you to keep all or most of your property, including your house and car. It

is important to find the right attorney to assist you in these trying times. Each case is different, and I

will work with you personally to determine whether bankruptcy is the best solution for you.

The main advantage to filing for bankruptcy is an "automatic stay", which stops all collection activity

and prohibits contact by creditors. An automatic stay is effective as soon as the bankruptcy is filed. It

may also stop foreclosure on your home, prevent a vehicle or other property from being repossessed,

and discharge unsecured debts.

I will discuss your financial situation with you and advise you as to the type of bankruptcy filing for

which you qualify.

Chapter 7 Bankruptcy:

A Chapter 7 "liquidation" bankruptcy allows you to receive a discharge, or cancellation, of many

types of unsecured debts. These discharged debts may include such debts as medical bills and credit

card debt. Debts which are not discharged include child support, alimony, tax debts, and student

loans (unless an undue hardship can be shown). Typically, you will be able to keep all or most of

your property, including your house and vehicle, under the exemptions provided by the Bankruptcy

Code.

The Chapter 7 bankruptcy process requires meeting certain income eligibility guidelines and takes

about four to six months to complete. It requires payment of a filing fee to the bankruptcy court,

filing of paperwork, and attendance at a brief creditors' hearing. Prior to filing, you will be required

to complete a brief credit counseling session, which is even available online.

Chapter 13 Bankruptcy:

A Chapter 13 bankruptcy requires you use a portion of your income to pay back all or a portion of

your debts over the course of a three- to five-year time period. A Chapter 13 bankruptcy requires the

same filing of forms and attendance at a creditor hearing as in a Chapter 7 bankruptcy. In a Chapter

13, however, you must also prepare a repayment plan providing for repayment of creditors. You

then make monthly payments which are distributed to your creditors by the bankruptcy Trustee as

per your plan. Once the plan is completed, any unpaid balances on qualifying unsecured debts are

discharged. Attorney's fees for a Chapter 13 bankrupcty case are typically able to be included in your

repayment plan.

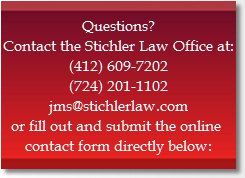

For a free consultation and evaluation of your bankruptcy issue call today at (412) 609-7202, (724)

201-1102, email jms@stichlerlaw.com, or fill out the online contact form to the left of this page. I am

available to meet with you at the location that is best for you and Saturday and Sunday consultations

are available.

We are a debt relief agency. We help people file for relief under the Bankruptcy Code.

Disclaimer: The information you obtain at this website is not, nor is it intended to be, legal advice. You should consult an attorney for advice regarding your individual situation. You are invited to

contact the Stichler Law Office, which welcomes your calls, letters and electronic mail. Contacting the Stichler Law Office does not create an attorney-client relationship. Please do not send any

confidential information to the Stichler Law Office until such time as an attorney-client relationship has been established.

Joseph M. Stichler Law Office, 335 Butler Street, P.O. Box 95176, Pittsburgh, PA 15223

(412) 609-7202

(724) 201-1102

jms@stichlerlaw.com